New York, NY (May 12, 2015) – Tenet Partners℠, a leading brand innovation and marketing consultancy, released today its 8th annual Top 100 Most Powerful Brands report, which ranks the top 100 corporate brands in terms of market awareness and reputation.

The Coca-Cola Company continues its lead as the #1 Most Powerful Brand – a distinction it has held since the Top 100 was first created in 2008. Amazon (#65) having jumped 20 places leads as the Top 100 ‘top riser.’ Apple (#5) continues it meteoric rise on the ranking, moving up five places from #10 last year. Since 2010, the tech giant has continued to strengthen its BrandPower score and climbed an impressive fifty-one places over the past five years.

Our findings show that some of the fastest-rising brands: Amazon (#65, +20), Intel (#94, +14), Google (#15, +11), and Apple (#5, +5), are outpacing their peers by reimaging customer experience. Through strategic acquisitions, collaborative brand partnerships, and continued investment in R&D, these leading brands are transforming their offerings to deliver greater value to their customers, businesses, and shareholders.

“The Top 100 Most Powerful Brands demonstrate that value creation stems from sustained investment to drive brand-led innovation and compelling customer experiences,” said Hampton Bridwell, CEO of Tenet Partners. By successfully fueling their business strategies with a more holistic approach to brand, digital and service design to meet customers’ needs and aspirations across diverse channels, the Top 100 brands are spurring growth – and creating market advantage over both the short and long term.”

Each year, Tenet Partners analyzes the data in the CoreBrand® Index (CBI) to determine the Top 100 Most Powerful Brands based on high market awareness and positive brand perceptions. Business decision makers at the top 20% of American corporations (VP level and above – representing the investment community, potential business partners, and business customers) are surveyed on two key metrics that contribute to a brand’s strength:

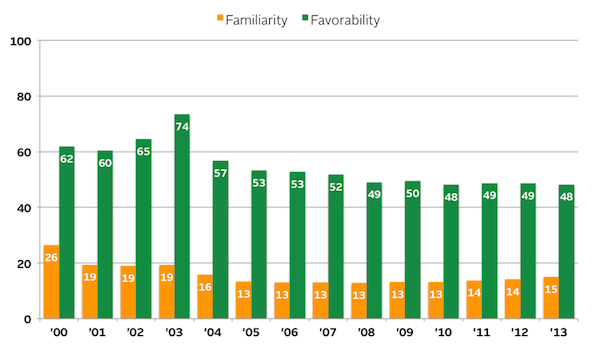

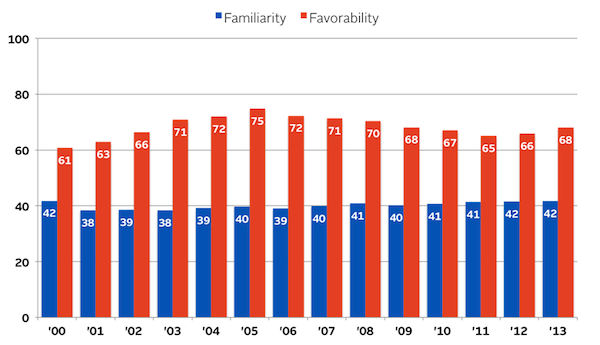

- Familiarity – Measures awareness of the brand. Respondents are considered to be familiar with a brand if they state they know more than just the company name. Familiarity scores range from 0 to 100.

- Favorability – The perception of the brand, based on how it performs across three key attributes: Overall Reputation, Perception of Management, and Investment Potential. Favorability scores also range from 0 to 100.

The quantitative Familiarity and Favorability metrics are then combined into a composite score called BrandPower – and are reported on a 100-rank scale. In order to be in the Top 100 Most Powerful Brands, companies must be considered a corporate brand and have been publicity traded and tracked by the CoreBrand Index for more than five years.

“Good management – both of the brand and of a company – results in two outcomes: strong familiarity and high favorability,” said James Gregory, Chairman of Tenet Partners. “By uncovering these two critical dimensions that contribute to brand health, business-decision makers can gain important intelligence in all the areas that define business success.”

Key Findings

_BrandPower is growing significantly across the board_

Five years ago, the average BrandPower score for the Top 100 was 60.7. This year, the average BrandPower is 63.1. This momentum is the strongest since the recession, suggesting that as corporations continue to invest in strategically building and managing their brand, they regaining the confidence of business-decision makers.

_Consumer Cyclicals made the strongest showing in the Top 100_

Companies that depend on the business cycle and economic conditions – such as automotive, entertainment and retail – are the single largest group in the Top 100, representing a total of 37 brands. Hailing from the Hotel & Entertainment industry, Walt Disney (#4) leads as the strongest consumer cyclical. Within the sector overall, Retail is the most represented industry with 14 ranked companies. Barnes & Noble is the top retail brand, rising to #29 this year.

_Communication spending is up overall, with bigger spenders reaping the most benefit_

The ten brands that moved up the most in the rankings this year have increased spending to drive familiarity at a much greater rate than the ten brands that declined the most. This demonstrates that the right level of investment, strategically allocated, will produce significant results.

Notable BrandPower Winners for 2015

The Coca-Cola Company (#1) – The #1 Most Powerful Brand of 2015

The Coca-Cola Company continued its lead as the #1 Most Powerful Brand. The 125-year-old Coca-Cola Company never rests on its laurels and continues to evolve around the ever-changing needs and wants of consumers. After falling yeas in a row, Coke’s U.S. soft-drink volumes rose 2.5% last summer, thanks in part to the hit “Share a Coke” campaign that will return this year. Also, last year, the company responded to health-conscious consumers by introducing Coca-Cola Life, a reduced-calorie cola naturally sweetened with cane sugar and stevia leaf extract.

Amazon (#65) – The Top 100 ‘Top Riser’

Amazon’s BrandPower has been on the rise since 2010. The company jumped 20 spots from its previous 2014 #85 position to enter at #65 this year. The brand excels at responding to, and often exceeding, consumers’ expectations of convenience, selection, and price. Built on a culture of innovation, the company spent upwards of $9.1 billion in research and development in 2014. Data-driven content and email marketing is a key success factor for the company. By leveraging rich information about its users, Amazon is able to create exceptional and intimate customer experiences.

Apple (#5) – Fastest-rising brand amongst the top 10

Apple jumped from #10th to #5th this year– becoming the fastest-rising brand amongst the top 10. Both its Familiarity and Favorability scores have increased, due in large part of its innovative products and outstanding market performance. The tech giant is bringing diverse elements together – talent, brands, new technologies to maintain its reputation for outstanding, relevant customer experiences.

Intel (#94) – Top new entrant to the Top 100

The California chipmaker is a new entrant into Top 100, having jumped fourteen places from #108. In late 2013, Intel created a new business unit specifically aimed at the Internet of Things (loT). Although the loT business only accounted for about 4% of Intel’s sales and operating income, it exceeded the company’s struggling mobile division, which posted an operating loss of $4.2 billion. This move promises to make Intel an important part of what should become a multi-brand experience embedded in the everyday lives of consumers.

Key Sector Trends

Three industry sectors tracked in the CBI – Technology, Financial Services, and Automotive – have experienced profound shifts and changes following the 2008 financial crisis. By building dynamic brands that defy industry norms, these leaders are delivering new experiences and driving value through innovation.

Technology

Brands hailing from the technology sector stand out as Top 100 ‘top risers.’ Of the top 10 biggest risers on the ranking, tech brands make up the five biggest BrandPower movers: Amazon (#65, +20), Intel (#94, +14), eBay (#32, +13), IBM (#32, +13) and Google (#15, +11). Amazon’s rise over the last five years is remarkable; up 74 places since 2010. Although CEO Jeff Bezos is not one to shy away from disrupting the status quo – from experimenting with delivering drones (and making a splash by talking about them on CBS’s _60 Minutes_) to acquiring Internet of Things platform 2lemetry – his vision for the brand has remained intact: to be the most customer-centric company on earth. Google follows close on Amazon’s heels, rising 73 places since 2010. The company is continuing to invest enthusiastically, from acquiring Nest, to experimenting with self-driving cars, to its most recent collaboration with Johnson & Johnson to help develop a robot-assisted surgery platform. These initiatives are helping Google extend its reach not only in the marketplace, but also in consumers’ minds.

Financial Services

Morgan Stanley (#57, +9), Charles Schwab (#64, +10), Wells Fargo (#97, +13) all experienced significant increases in BrandPower, as the United States banking industry continues to recover from the global financial crisis. A key strategy for financial services brands has been a renewed focus on customer experience. For example, a hallmark of Well Fargo’s corporate vision is its “One Wells Fargo” initiative. With a diverse range of products and business – banking, investments, mortgage, and insurance – One Wells Fargo serves an enterprise-wide guiding principle. It offers a roadmap for engaging with customers across multiple business lines in addition to providing collaboration strategies across business units.

Automotive

After years of soft performance due to the recession, consumers are giving in to pent-up demand and are purchasing cars with a vengeance. According to tracking company Autodata, 16.5 million new autos hit the streets in 2014 – the highest number since the record of 16.9 million in the pre-recession days of 2006. Despite rising sales, the majority automotive companies slid in the BrandPower: Harley-Davidson (#10, -5), BMW (#21, -4), Volkswagen (#31, -4), Honda (#36, -6), Toyota (#42, -5), Volvo (#44, -8), Ford Motor (#49, +2), General Motors (#61, no change), Nissan Motors (#83, -6). Ford (#49, +2) is the uncontested industry leader, increasing its BrandPower year-over-year. Former President and CEO, Alan Mulally, has described Ford as being a technology company as much as a car company. The automaker is a leader among American car companies in hybrid technology, with its Fusion Energi winning 2013 Green Car of the Year. The company also pioneered enhancing the driver experience through technology with one of the first integrated connectivity systems, Ford Sync. Since its debut in 2007, the technology has continued to evolve and become more customer-friendly

The Most Powerful Brands of 2015 Website

View the full list of the Top 100 Most Powerful Brands. The full report is available to download by visiting tenetpartners.com/top100.

About Tenet Partners

Formed from the merger of Brandlogic and CoreBrand, Tenet Partners is a brand innovation and marketing consultancy that helps companies create brand value and unearth business opportunities by putting customers at the center of their business strategies.

For more information, please contact:

Russ Napolitano

Chief Operating Officer

Tenet Partners

+ 1 212 329-3035

rnapolitano@tenetpartners.com