Sustainability Accounting Standards Board (SASB)

Transforming capital markets globally

In the world of capital markets, investors need to understand how a business, regardless of industry, will remain viable and deliver a desired financial return. To make good investment decisions, they need to account for both financial and non-financial issues that are material to a company and its ability to sustain its future.

The challenge that investors face is access to essential information that goes beyond what’s found in traditional annual reports and financial statements. Today’s enterprises must navigate a complex and dynamic landscape of regulations and resource uncertainty—and they must be able to assess and report on how all of these factors affect their operations and risk exposure, in order to maintain the confidence of investors.

Facilitating performance reporting around non-financial issues is what the Sustainability Accounting Standards Board (SASB) was created to do. Formed in partnership with Bloomberg, SASB was modeled on the Financial Accounting Standards Board (FASB), which formulates and oversees the benchmarks used for financial reporting.

Together, SASB and FASB provide a comprehensive and consistent set of standards that give investors a more complete understanding of a company’s current performance and future prospects.

As a founding member of SASB’s advisory council, Tenet Partners played a critical role in helping Dr. Jean Rogers, its visionary founder, create a brand that would immediately establish the organization’s credibility within the business, capital markets and regulatory community that was equal to any other in the realm of standards-setting organizations.

In addition to the research, strategy and identity work at the heart of any successful brand, the Tenet team partnered with SASB to create an information architecture designed to make a company’s sustainability metrics more accessible and easier for investors to use.

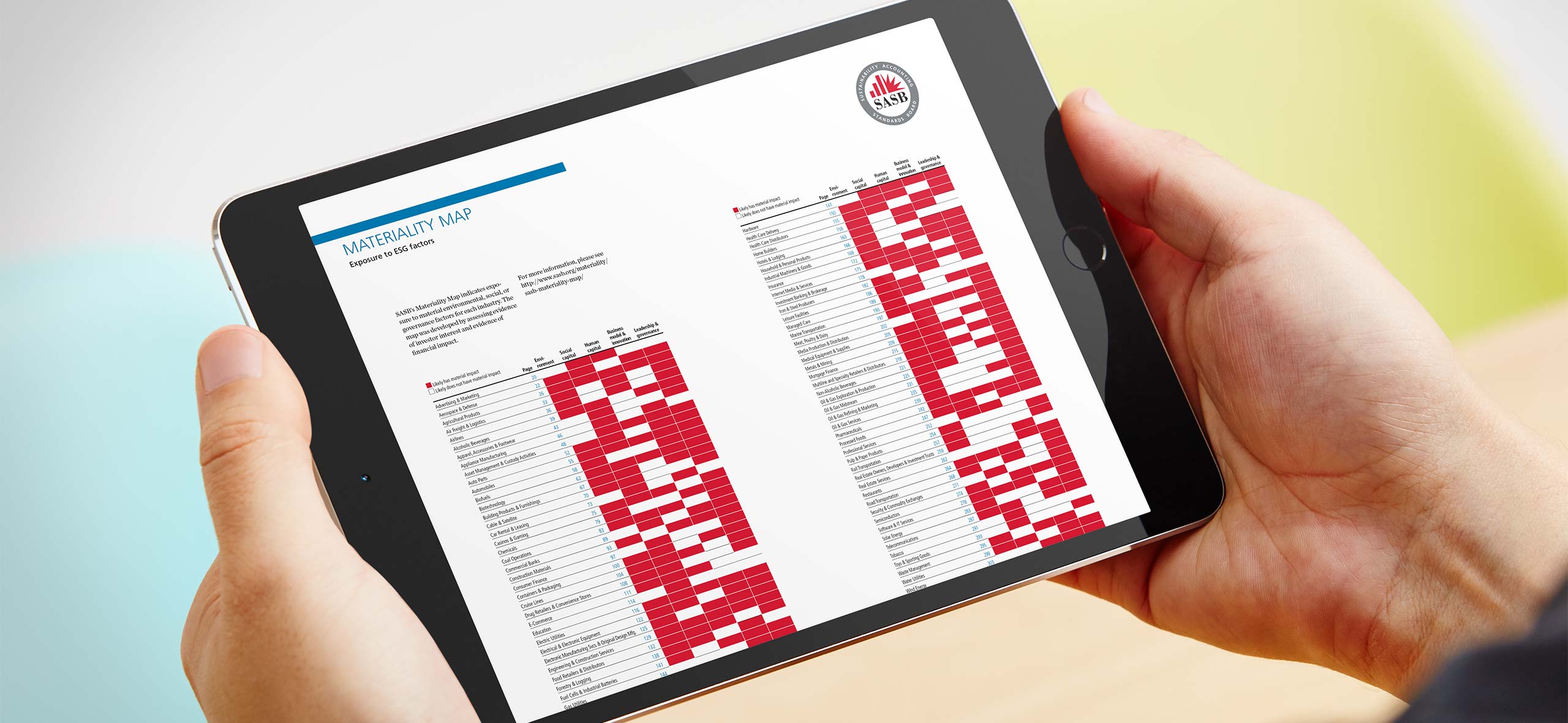

The result was the highly interactive SASB Materiality Map, which provides an at-a-glance view of materiality scores by industry and issue, allowing click-through access to the data behind the score. By translating a complex data set into something digestible and easy to use, it helps enterprises organize and prioritize the issues that are most important to them—and their investors.

The launch of SASB established it as an essential enabler of standardized sustainability reporting in the United States. Thanks to this success and widespread adoption of its standards, in 2022, the International Sustainability Standards Board (ISSB) of the IFRS Foundation assumed responsibility for the SASB Standards and moved them to a global approach embraced by capital markets worldwide.