Over the holiday season, I started noticing numerous year-in-review videos in my admittedly seldom-visited Facebook feed. At the end of 2013, when Facebook produced a similar offering, I recall being utterly impressed with the engineering effort — and the overall computing resources it must require — to create a customized video on demand for every one of their billion users.

Facebook, overall, does an extraordinarily good job with the production and presentation of these videos. They are personal, emotional and a great way to celebrate your year with your friends and loved ones.

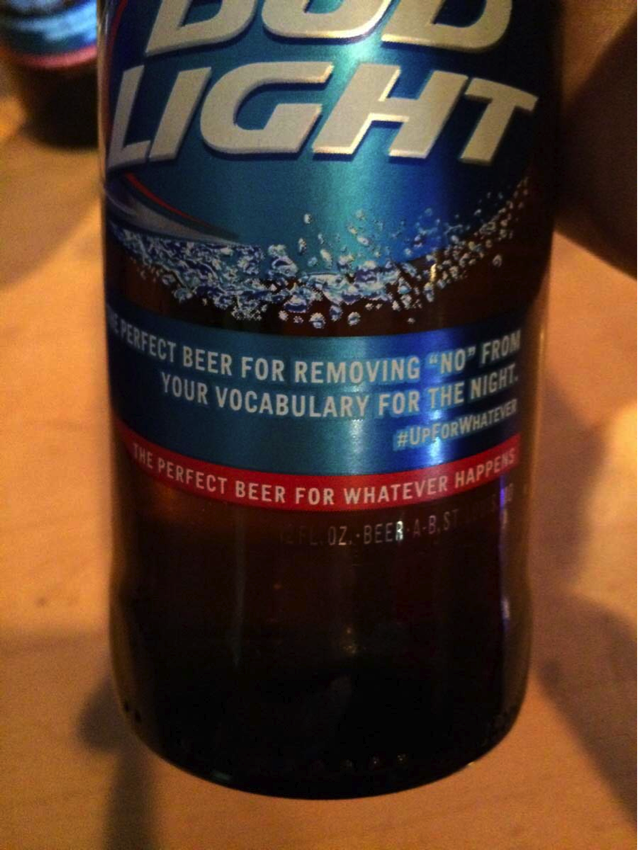

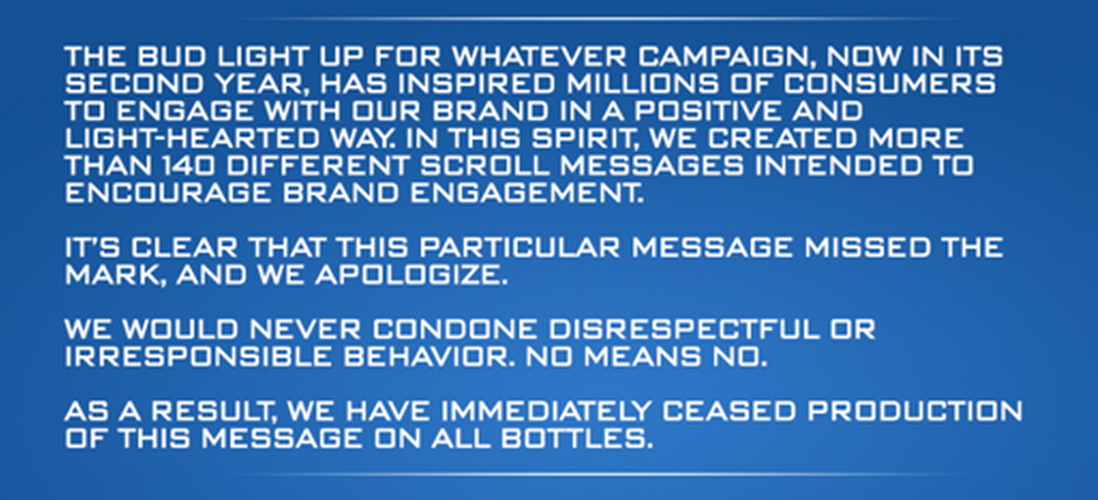

However, let’s focus on that word “celebrate”. A problem with the way Facebook introduces these videos becomes crystal clear when you have a year that you don’t particularly want to celebrate. Eric Meyer, a long-time champion of web standards, tragically lost his little girl in 2014 and publicly journaled throughout the ordeal on his blog and on Twitter. The video preview that Facebook automatically set up for him, and forcibly showed itself in his feed, featured his daughter with her portrait on top of a celebratory background. I’m sure for anyone in his situation that would elicit a raw wave of emotions, the exact opposite of what Facebook would have liked to spark for you. He wrote about the experience in his brilliantly crafted article, Inadvertent Algorithmic Cruelty. The piece grew some legs and was picked up by major news outlets around the world. Eventually Facebook issued an apology.

What’s the lesson here for us software designers? Certainly Facebook didn’t mean to cause grief, and Eric was understanding and reasonable, knowing full well that this was not a result of malice, but of a use case not considered in the original design of the software.

I consider it a call for empathy. Let our humanity shine through the software we design. Empathize with not only your ideal user, but for the unexpected. Consider the different realities that your audience might be approaching you with.

For Facebook’s year-in-review, rather than automatically including it precompiled in your feed for you, they can simply ask whether you’d like to see your video. Perhaps next to the question they can include examples from your friends who have chosen to publish their videos already, so that expectations can be set.

There are all kinds of scenarios that designers cannot possibly know at the time a feature is being created, and they vary on the site or tool and the audience expected to visit. For example, if you’re a health care provider, the overwhelming majority of your audience may be there to learn about the services and benefits you provide. But, perhaps some consideration should also be made for people coming to your site who are in desperate need for information on a personal health emergency. Or, take a broader crisis with the snowstorm that hit the northeast this past week. In the event that all roads and public transit in New York City shut down in anticipation of the storm, a well considered city website would have an area to prominently display updated bus and subway schedules, and what to do if you found yourself stranded with no way to get home.

I think the most important takeaway for designers is to embrace our humanity, and design as if the software we build was human, too.

Eric Meyer expounded on the idea of designing for crisis in a recent podcast at The Web Ahead, which is well worth listening to.

Have you ever had any experience where technology or software made presumptions about you that just were off the mark? If so, what was this experience and did you do anything about it?